“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.” - John Maynard Keynes

Thursday, January 29, 2009

Financial Crisis - Resolution Next Week?

I have been back and forth on the Bad Bank idea, and I really hope it works but I am very worried about a give away. At $4 trillion price tag, nationalization sounds more feasible. Obviously, the numbers are going to be politically difficult.

I am somewhat comforted by the fact that Geitner has probably looked at this little manual from Roubini and Setser.

Supermajortiy

This possible placement of a Democrat by the Democratic Governor of New Hampshire with the imminent Franken seating soon will create a Democratic Supermajority in the Senate.

Friday, January 23, 2009

TARP

1.) How Much the Government is on the Hook For.

The report details the TARP as of Dec 31, 2008. At that point $247 billion of the $350 billion allocated had been disbursed to about 218 institutions. Based on a Present Value model, the CBO believes the government has subsidized $64 billion (or 26%) of all loans, purchases, and infusions. This means that the $247 billion invested is worth $183 billion today.

2.) How Companies will Pay the Government Back.

An odd characteristic is the structure and repayment scheme. Most are structured in a way that the government purchased preferred shares that pay a dividend (that increases its yield after 5 years), and the government has the ability to convert those shares to common stock at any point in time.

Although that is the most common structure, there is a higher yield from AIG, a different asset warrant structure for part of Citi's injection, and loans to the automakers on different terms.

Throughout the various terms the government will be repaid through dividends, repayment, conversion and sale of common, or a combination of all three.

3.) Success

It seems as though, this program has helped stop the bleeding. Although moral hazard and political influence have run rapid, the financial system has been slowly but surely improving. To be perfectly honest, it is hard to say how far we would have slid without this injection.

And if things improve the government could get much of the money back.

4.) Reforms

(a) First, there needs to be a systematic way to address each and every TARP application. The Citi deal was a complete diversion from the way other institutions have been treated. So, a more coherent policy that is tough and transparent, so banks know where they stand. I do not know exactly what this would look like, but it would not look like the bandage and duck tape system currently in place.

(b) Second, on the accountability and sacrifice front. These companies are all (including the automakers) coming to the government because of bad business decisions and because of an unprecedented financial crisis. These companies should have to give up a considerable amount (like $1.2 million redecorating, yes you John Thain). Oddly enough the only standard that looks close to correct is the one imposed on the automakers. The rules should be adopted should include no dividends, no share repurchases, severely restricted executive compensation, report plans for restructuring, report the on the financial viability of the company (either publicly or to the FED Chair and the Treasury Secretary), and renegotiated severance packages.

Also, the terms on the deals should be much more favorable for the government and the taxpayers. An example is that in exchange for government money, these banks should have to start lending to credit worthy consumers and businesses. This will look like temporary nationalization, but that may be what it will take to jump out of this crisis.

Inauguration

Friday, January 16, 2009

America's BadAsset Bank

I the surface I think this plan has some merit. With the TED Spread still twice its normal level, and with more housing related losses surely to come, we absolutely need some bold action.

Now, the exact details were not released, but my best guess is that this new entity would work like the trading desk at the FED or at some nameless bank. They would prime the liquidity pump for various frozen markets, and continuously buy and sell toxic assets.

There are surely few positive attributes and opportunities in this plan. One, these assets are probably wildly undervalued, and even if held until maturity the government would end up making a little bit of coin. Two, that the buying and selling of assets or churning (as my former economics professor called it - and which is also illegal for lay people) may make the government money as it does for the Federal Reserve in their buying and selling of Treasuries. Three, most of all banks will be in a be more solvent, and markets more generally will gain confidence. After the Lehman default fear of counterparty default was like a cold chill felt down the spines of all market participants. This phenomenon almost surely gets overblown because not everyone can default, but that's not what credit markets were saying during the throws of the crisis. My guess is this risk would be greatly reduced by this BadAsset Bank, and maybe the progress in credit spreads would continued at an even faster rate.

There are also surely a few negative attributes and opportunities in this plan. First, there is the Krugman concern that the government would waste the money through such a mechanism, and may well pay too much for the toxic assets. Second, there is the size concern, can these markets be affected by such a small amount of money relative to their size. Third, it is possibly that all firms may decide that the creation of the BadAsset Bank would signal a great time to run to the exits, which may further push down asset prices (that said I do not know the likelihood and it may have just the opposite effect).

Now, all of this must be taken in context. I have not seen any draft of this plan, so the details may be operational different than my assumptions and the negatives and risks may be mitigated by the details. My hope is that this idea or something that looks like it, such authority for Treasury or the FED to take on the same responsibilities, are taken seriously. Obviously, the merit in an independent (perhaps emergency) vehicle would be preferable because it would have a more concise, well-defined set of goals and responsibilities than a similar plan in the hands of Treasury or the FED would have.

That is a lot to take in. I surely do not have a comprehensive understanding of the entire idea, but I will try to learn more and synthesize it here in the days to come.

Deflation - On Every Front Imaginable

The ugly head of deflation has once again shown itself, and it scares me quite a bit. Link to latest BLS deflationary CPI. There are two major concerns that I have about deflation.

The first is asset deflation. Housing is the example that has been true for a very long time. People are foregoing the purchase of houses with the knowledge that prices will be less at a future date. This has caused contraction in the housing industry and all industries related to housing (e.g. Construction, Mortgage Banking, Basic Materials). Then, there is the wealth effect on home owners who will spend less because they feel poorer because their house is worth less. There are also externalities in localities and neighborhoods caused by the default and foreclosure phenomenon.

The other asset deflation happened in financial markets. As stocks declined and credit tightened, margin calls ripped through the financial system. This caused individuals, firms, and banks to sell assets to meet margin calls which further caused declines in asset prices. Again this too causes a wealth effect that reduces overall spending.

The second is price deflation or deflation expectations. In his landmark Nobel work on inflation expectations, Milton Friedman showed us that the macroeconomic challenge we faced was not just a trade-off between unemployment and inflation. He posited that when inflation rose too high, inflation expectations would cause stagflation (a period of high inflation and high unemployment). Friedman was bucking the popular trend at the time that if policymakers let inflation rise unemployment would fall. The intuition behind his theory was that as prices rose, workers would demand high wages causing prices to rise further - inflationary expectations causing an inflationary spiral. So, in the 1970s when inflation rose and at a point unemployment began to rise as well, he began his rise to prominence.

Many who are students of the Friedman/Hayek (or Chicago) School of thought, have begun or continued to see the world only through the scope of inflation expectations, but today the real fear should be deflationary expectations. Very similar to the theories and ideas articulated by John Manard Keynes during the Great Depression (some not all). The intuition is very similar to inflationary expectations, just in the opposite direction. When monetary policy makers can no longer effectively increase the money supply (or cause some level of inflation) and when prices are falling they continue to fall. Basically, consumers forgo large portions of consumption with the understanding the prices will fall in the future. This foregone consumption reduces sales, increases inventories, and forces business to close and/or lay-off workers. The greater number of unemployed workers reduces overall demand in the economy which exacerbates the entire deflationary cycle (or spiral).

Can We Prevent Deflation?

My hope is that the multi-front war the Obama Administration plans to fight will make a dent in this cycle. First, the stimulus package which I just hope and pray will be large enough. Second, the TARP money with I hope and pray will stem the foreclosure tide, and renew greater confidence and solvency to the financial system. Third, renewed and restructured financial regulation to bring back confidence in financial markets. Fourth, a large sweeping reform of the health care system to curtail rising costs and stem the bankruptcies directly caused by health care expenses.

I know the TED Spread has narrowed in recent days which means there is less fear in markets, but it is still double the ordinary spread and I think the real economy could cause that fear to come back rather quickly.

We might all need to find religion.

Wednesday, January 14, 2009

Wall Street Journal Poll

Mr. Ponzi and Mr. Madoff

Tuesday, January 13, 2009

Hilary Clinton

Monday, January 12, 2009

Reform

Can We Spend Enough Money?

There are plenty of projects out there that need to be pursued:

- Roads

- Bridges

- Broadband lines

- Schools

- Green Federal Building

But my worry is not that we will spend too much, but that we will spend to little, below are a few other projects to be taken up, a few statistics, and my view summarized.

- Light Rail Projects (suburban to urban)

- High Speed Rail Projects

- Spending to fight childhood poverty

- Smart Grid

- Health Care Reform

But lets get the most bang for our buck short and long-term:

Friday, January 9, 2009

TARP

Thursday, January 8, 2009

A Debate Perhaps?

Wednesday, January 7, 2009

Disappointment

- temporary increase in food stamps - 1.73

- extend unemployment insurance benefits - 1.64

- increase infrastructure spending - 1.59

- accelerated depreciation - 0.27

- extending the Bush tax cuts - 0.29

- cut corporate taxes - 0.30

Sunday, January 4, 2009

Sixteen Days

Friday, January 2, 2009

Little Break ... Lets Talk a Little about Productivity Growth

Today, I watched Paul Volcker on charlierose.com (Volcker has been on some 5 or 6 times since 1997). The first interview was the central banking legend talking about the economy in 1997. First and foremost, what vision the man had as he talked positively about the prospects of the economy which would boom 1998-2000. The second point that caught my attention was his point about productivity growth.

(The paragraphs to follow are estimates based on numbers I have seen, and I will try to follow with more well-defined facts and sources tomorrow.)

Since 1979 there have been only about 6 or 7 years of outstanding productivity growth and in turn economic growth. By my best estimate they would be 1983-1985, 1988, and 1997-1999. If one looks at the prior 30 years the productivity growth and economic growth numbers were considerably better.

Why?

On the economic growth side a factor that may contribute by about one percent is population growth as an input to economic growth, once the boomer generation was done entering the labor force that input declined.

Another important factor was one articulated by Mr. Volcker in his interview, and that is measuring productivity growth. By his estimation (and I partly agree), an industrial based manufacturing economy was easier to measure than a service based economy. Inputs and Outputs are much easier to measure when it is machines rather than content on paper.

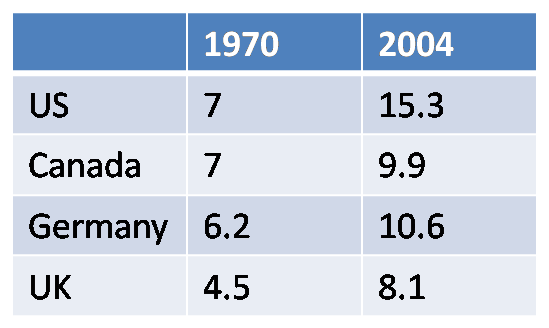

I would argue two additional points. One, that the G.I. Bill and other educational spending ushered in an era of greater productivity growth and technological advance. Two, that New Deal liberalism and progressive policies ushered in shared prosperity and higher incomes for middle and lower income families. This increase in wages was broadly an incentive to work harder and increase productivity at a faster clip. Another piece of that New Deal policy ideal is that of broader macroeconomic measures, and most specifically health care spending as a percentage of GDP. Below is a nice graph I grabbed from Paul Krugman based on information he got from CMS.

This health care problem affects the United States in three ways.

First, it is like a tax on firms to come to the United States because of health care. In other words health care makes us less competitive, anecdotely there has been a Dell Call Center I heard about recently built in Ireland and a Honda plant built in Canada. I'm sure that wasn't the only reason, but it was the reason cited.

Second, is overall health and wellness of the workforce. The World Economic Forum's Global Competitive Index uses this as a parameter, and it seems logical that a healthier workforce might to some extent be a more productive workforce.

Third, is the crowding out that can be seen in the graph above. Conservatives often make the argument that "big government" spending crowds out private investment (which is plausible and has happen), but recently health care spending has crowded out private and public investment in much the same way. In other words every dollar spent on health care is a dollar not spent on R and D in the automobile industry or really an industry of your choosing.

Does it Matter?

One argument most critics of my argument would make is that the lower productivity growth numbers have been offset by longer more protracted periods of modest growth. So, eight years of modest growth and a shallow recession is better than six years of large growth and a fairly large recession. It is hard to say how plausible that argument is, but it seems to me that in the 1950's and 1960's we had both large growth and fairly modest recessions.

Conclusion

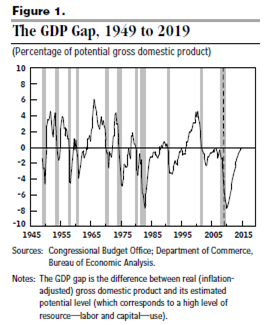

This is an interesting topic of discussion, especially in a period of time in which the decline in GDP will be unparalleled since the Great Depression. This couple with the fact that many economists worry that the recovery in 2010 and beyond could mirror the lost decade Japan experienced in the 1990's if policy makers do not handle the situation effectively.

There are more serious issues to address right now, but it seems to me that if the fiscal stimulus is done right we could get some measure in it that could mirror policies of the success post-war boom era.