Today, I watched Paul Volcker on charlierose.com (Volcker has been on some 5 or 6 times since 1997). The first interview was the central banking legend talking about the economy in 1997. First and foremost, what vision the man had as he talked positively about the prospects of the economy which would boom 1998-2000. The second point that caught my attention was his point about productivity growth.

(The paragraphs to follow are estimates based on numbers I have seen, and I will try to follow with more well-defined facts and sources tomorrow.)

Since 1979 there have been only about 6 or 7 years of outstanding productivity growth and in turn economic growth. By my best estimate they would be 1983-1985, 1988, and 1997-1999. If one looks at the prior 30 years the productivity growth and economic growth numbers were considerably better.

Why?

On the economic growth side a factor that may contribute by about one percent is population growth as an input to economic growth, once the boomer generation was done entering the labor force that input declined.

Another important factor was one articulated by Mr. Volcker in his interview, and that is measuring productivity growth. By his estimation (and I partly agree), an industrial based manufacturing economy was easier to measure than a service based economy. Inputs and Outputs are much easier to measure when it is machines rather than content on paper.

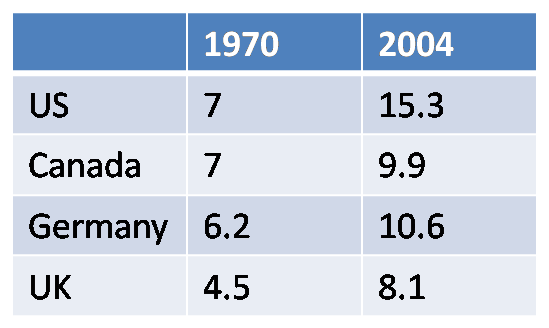

I would argue two additional points. One, that the G.I. Bill and other educational spending ushered in an era of greater productivity growth and technological advance. Two, that New Deal liberalism and progressive policies ushered in shared prosperity and higher incomes for middle and lower income families. This increase in wages was broadly an incentive to work harder and increase productivity at a faster clip. Another piece of that New Deal policy ideal is that of broader macroeconomic measures, and most specifically health care spending as a percentage of GDP. Below is a nice graph I grabbed from Paul Krugman based on information he got from CMS.

This health care problem affects the United States in three ways.

First, it is like a tax on firms to come to the United States because of health care. In other words health care makes us less competitive, anecdotely there has been a Dell Call Center I heard about recently built in Ireland and a Honda plant built in Canada. I'm sure that wasn't the only reason, but it was the reason cited.

Second, is overall health and wellness of the workforce. The World Economic Forum's Global Competitive Index uses this as a parameter, and it seems logical that a healthier workforce might to some extent be a more productive workforce.

Third, is the crowding out that can be seen in the graph above. Conservatives often make the argument that "big government" spending crowds out private investment (which is plausible and has happen), but recently health care spending has crowded out private and public investment in much the same way. In other words every dollar spent on health care is a dollar not spent on R and D in the automobile industry or really an industry of your choosing.

Does it Matter?

One argument most critics of my argument would make is that the lower productivity growth numbers have been offset by longer more protracted periods of modest growth. So, eight years of modest growth and a shallow recession is better than six years of large growth and a fairly large recession. It is hard to say how plausible that argument is, but it seems to me that in the 1950's and 1960's we had both large growth and fairly modest recessions.

Conclusion

This is an interesting topic of discussion, especially in a period of time in which the decline in GDP will be unparalleled since the Great Depression. This couple with the fact that many economists worry that the recovery in 2010 and beyond could mirror the lost decade Japan experienced in the 1990's if policy makers do not handle the situation effectively.

There are more serious issues to address right now, but it seems to me that if the fiscal stimulus is done right we could get some measure in it that could mirror policies of the success post-war boom era.

No comments:

Post a Comment